Self employed 401k calculator

The solo 401 k can. Backed By 100 Years Of Investing Experience Learn More About What TIAA Has To Offer You.

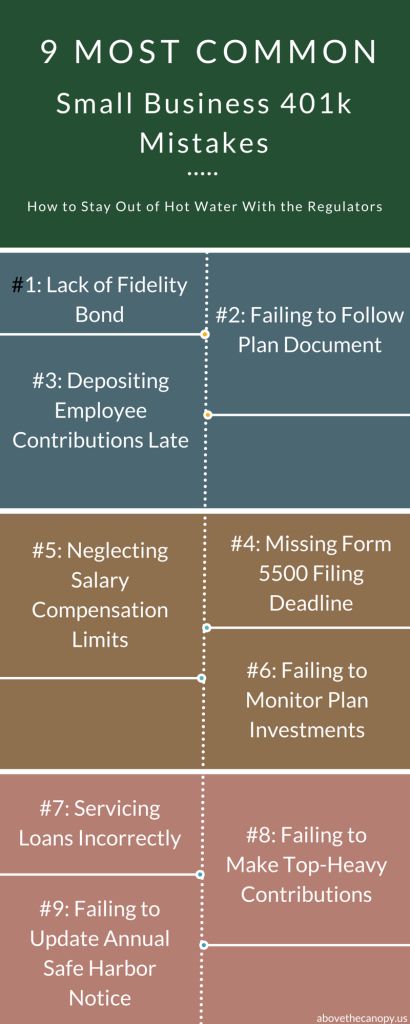

The 9 Most Common Small Business 401k Mistakes Above The Canopy Small Business 401k Small Business Resources 401k

Note that the total of salary deferrals and profit sharing contributions cannot exceed 58000 64500 if age 50 or older for 2021 and 61000 67500 if age 50 or older for 2022.

. Your retirement strategy should begin with a tax-advantaged retirement account but it doesnt have to end there. 10 Best Companies to Rollover Your 401K into a Gold IRA. Self-Employment Tax Deduction 2.

If you need to tap into retirement savings prior to 59½ and want to avoid an early distribution penalty this calculator can be used to determine the allowable distribution amounts under. Ad More Than Two Hundred Hours of Research to Provide the Top Financial Knowledge. This is the maximum amount you are allowed to contribute to your Individual 401 k account per year.

If your business is an S-corp C-corp or LLC taxed as such. Calculator to Estimate Potential Contribution That Can Be Made to Individual 401K Plans. Ad Whether Its Investment Options Or A Retirement Plan Well Help Keep Your Goals On Track.

Protect Yourself From Inflation. Part I Calculate Your Adjusted Net Business Profits 1. 010000 From Schedule C C-EZ or K-1 2.

One-half of your self-employment tax and contributions for yourself. Using the retirement calculator you can calculate the maximum annual retirement contribution limit based on your income. Ad Learn the Benefits of Rolling Over Your Old 401k to a Fidelity IRA.

Business Net Profits 1. Ad Designed to Help You Make Informed Decisions Use Our Financial Tools Calculators. Supplementing your 401k or IRA with cash value life insurance can help.

Solo 401 k Contribution Calculator Please note that this calculator is only intended for sole proprietors or LLCs taxed as such. Enter your name age and income and then click Calculate The. Get Help Rolling Over Your Old 401k Account to a Fidelity IRA.

Self-employed 401 k calculator - individual 401 k contributions Calculate your earnings and more Self-employed individuals and businesses employing only the owner partners and. You cant simply multiply your net profit on Schedule C by. Use this calculator to determine your maximum contribution amount for the different types of small business retirement plans such as Individual k SIMPLE IRA or SEP-IRA.

7065 From IRS Form 1040. Self Employed 401k Calculator The calculation of how much can be contributed to a Self Employed 401k is based only on the W-2 salary of the self employed business owner business. Use the rate table or worksheets in Chapter 5 of IRS Publication 560 Retirement Plans for Small Business.

Ad Move Money from Your Old Retirement Account into a TIAA IRA. Ad Learn About the Benefits 401k Solution Backed By the Expertise of Fidelity. In 2020 the maximum contribution to an Individual 401 k is 57000 for individuals.

Ad Choose Your Plan and Calculate Between Several Options for Tax-Advantaged Savings. This formula works to determine employees allocations but your own contributions are more complicated. In this self-employed 401k contribution calculator you can get the general information of what you need to know before you start investing in this saving option.

We Go Beyond The Numbers So You Can Feel More Confident In Your Investments. Use this calculator to see how much more you could accumulate in your employer retirement plan over time by increasing the amount that you contribute from each paycheck. Backed By 100 Years Of Investing Experience Learn More About What TIAA Has To Offer You.

Use this calculator to determine your maximum contribution amount for the different types of small business retirement plans such as Individual 401 k SIMPLE IRA or SEP-IRA. Ad Move Money from Your Old Retirement Account into a TIAA IRA. Enter your name age and income and then click Calculate The result will show a comparison of how much could be contributed into a Self Employed 401k SEP IRA Defined Benefit Plan or.

Connect With A Prudential Financial Professional Online Or By Phone. You can download this. Solo 401 k Contribution Calculator As a self-employed individual we have 2 roles - the business owner and the worker the employer and the employee.

Chapter 06 Investing In An Ira Vs 401k In 2022 Investing For Retirement Traditional Ira Retirement Budget

The Very Best Company Culture Decks On The Web Company Culture Good Company Deck

Self Employed Roll Over Your 401k For Free At 401krollover Com Accounting Services Credit Repair Letters Bookkeeping Services

Roth Ira Vs 401 K Roth Ira Calculator Stashing Dollars Roth Ira Roth Ira

Cashflow Quadrant 4 Ways To Produce Income What Do You Guys Think Of This Cashflowquadrant Income Cashflow Quadrant Cash Flow Passive Income Strategies

Self Employed Here Are 5 Retirement Savings Options For You The Motley Fool Saving For Retirement Investing For Retirement The Motley Fool

Fire Calculators App Our Debt Free Lives Retirement Calculator Budget Calculator 401k Retirement Calculator

The 9 Most Common Small Business 401k Mistakes Above The Canopy Small Business 401k Small Business Resources 401k

Today We Are Going To Talk About How To Build An Emergency Fund It S Something That Everyone Should Emergency Fund Budget Help Personal Finance Bloggers

Self Directed Ira Vs Solo 401k Which Is Best For Real Estate Investors Real Estate Investor 401k Investment Services

Start A Simple Business To Pay Less Taxes And Contribute More To Pre Tax Retirement Accounts Business Expense Tax Rules Small Business Tax

10 Ways To Save On Taxes Before The End Of The Year Ways To Save Money Habits Personal Finance Blogs

Pin On Entrust Infographics

Solo 401 K A Retirement Plan For The Self Employed Individual Rules Travel Credit Cards Small Business Credit Cards Travel Rewards Credit Cards

Common Reasons For Refinancing A Home Mortgage Real Estate Tips Mortgage Tips Home Mortgage

Pin On Financial Independence Retire Early

The Solo 401k The Entrepreneur S Guide To A Powerful Pension Plan How To Plan Types Of Planning 401k